QUOTING PRESIDENT OF RUSSIA VLADIMIR PUTIN:

Federation Council members, State Duma deputies, good afternoon. Representatives of the Republic of Crimea and Sevastopol are here among us, citizens of Russia, residents of Crimea and Sevastopol!

Dear friends, we have gathered here today in connection with an issue that is of vital, historic significance to all of us. A referendum was held in Crimea on March 16 in full compliance with democratic procedures and international norms.

More than 82 percent of the electorate took part in the vote. Over 96 percent of them spoke out in favour of reuniting with Russia. These numbers speak for themselves.

To understand the reason behind such a choice it is enough to know the history of Crimea and what Russia and Crimea have always meant for each other.

Everything in Crimea speaks of our shared history and pride. This is the location of ancient Khersones, where Prince Vladimir was baptised. His spiritual feat of adopting Orthodoxy predetermined the overall basis of the culture, civilisation and human values that unite the peoples of Russia, Ukraine and Belarus. The graves of Russian soldiers whose bravery brought Crimea into the Russian empire are also in Crimea. This is also Sevastopol – a legendary city with an outstanding history, a fortress that serves as the birthplace of Russia’s Black Sea Fleet. Crimea is Balaklava and Kerch, Malakhov Kurgan and Sapun Ridge. Each one of these places is dear to our hearts, symbolising Russian military glory and outstanding valour.

Crimea is a unique blend of different peoples’ cultures and traditions. This makes it similar to Russia as a whole, where not a single ethnic group has been lost over the centuries. Russians and Ukrainians, Crimean Tatars and people of other ethnic groups have lived side by side in Crimea, retaining their own identity, traditions, languages and faith.

Incidentally, the total population of the Crimean Peninsula today is 2.2 million people, of whom almost 1.5 million are Russians, 350,000 are Ukrainians who predominantly consider Russian their native language, and about 290,000-300,000 are Crimean Tatars, who, as the referendum has shown, also lean towards Russia.

True, there was a time when Crimean Tatars were treated unfairly, just as a number of other peoples in the USSR. There is only one thing I can say here: millions of people of various ethnicities suffered during those repressions, and primarily Russians.

Crimean Tatars returned to their homeland. I believe we should make all the necessary political and legislative decisions to finalise the rehabilitation of Crimean Tatars, restore them in their rights and clear their good name.

We have great respect for people of all the ethnic groups living in Crimea. This is their common home, their motherland, and it would be right – I know the local population supports this – for Crimea to have three equal national languages: Russian, Ukrainian and Tatar.

Colleagues,

In people’s hearts and minds, Crimea has always been an inseparable part of Russia. This firm conviction is based on truth and justice and was passed from generation to generation, over time, under any circumstances, despite all the dramatic changes our country went through during the entire 20th century.

After the revolution, the Bolsheviks, for a number of reasons – may God judge them – added large sections of the historical South of Russia to the Republic of Ukraine. This was done with no consideration for the ethnic make-up of the population, and today these areas form the southeast of Ukraine. Then, in 1954, a decision was made to transfer Crimean Region to Ukraine, along with Sevastopol, despite the fact that it was a federal city. This was the personal initiative of the Communist Party head Nikita Khrushchev. What stood behind this decision of his – a desire to win the support of the Ukrainian political establishment or to atone for the mass repressions of the 1930’s in Ukraine – is for historians to figure out.

What matters now is that this decision was made in clear violation of the constitutional norms that were in place even then. The decision was made behind the scenes. Naturally, in a totalitarian state nobody bothered to ask the citizens of Crimea and Sevastopol. They were faced with the fact. People, of course, wondered why all of a sudden Crimea became part of Ukraine. But on the whole – and we must state this clearly, we all know it – this decision was treated as a formality of sorts because the territory was transferred within the boundaries of a single state. Back then, it was impossible to imagine that Ukraine and Russia may split up and become two separate states. However, this has happened.

Unfortunately, what seemed impossible became a reality. The USSR fell apart. Things developed so swiftly that few people realised how truly dramatic those events and their consequences would be. Many people both in Russia and in Ukraine, as well as in other republics hoped that the Commonwealth of Independent States that was created at the time would become the new common form of statehood. They were told that there would be a single currency, a single economic space, joint armed forces; however, all this remained empty promises, while the big country was gone. It was only when Crimea ended up as part of a different country that Russia realised that it was not simply robbed, it was plundered.

At the same time, we have to admit that by launching the sovereignty parade Russia itself aided in the collapse of the Soviet Union. And as this collapse was legalised, everyone forgot about Crimea and Sevastopol – the main base of the Black Sea Fleet. Millions of people went to bed in one country and awoke in different ones, overnight becoming ethnic minorities in former Union republics, while the Russian nation became one of the biggest, if not the biggest ethnic group in the world to be divided by borders.

Now, many years later, I heard residents of Crimea say that back in 1991 they were handed over like a sack of potatoes. This is hard to disagree with. And what about the Russian state? What about Russia? It humbly accepted the situation. This country was going through such hard times then that realistically it was incapable of protecting its interests. However, the people could not reconcile themselves to this outrageous historical injustice. All these years, citizens and many public figures came back to this issue, saying that Crimea is historically Russian land and Sevastopol is a Russian city. Yes, we all knew this in our hearts and minds, but we had to proceed from the existing reality and build our good-neighbourly relations with independent Ukraine on a new basis. Meanwhile, our relations with Ukraine, with the fraternal Ukrainian people have always been and will remain of foremost importance for us.

Today we can speak about it openly, and I would like to share with you some details of the negotiations that took place in the early 2000s. The then President of Ukraine Mr Kuchma asked me to expedite the process of delimiting the Russian-Ukrainian border. At that time, the process was practically at a standstill. Russia seemed to have recognised Crimea as part of Ukraine, but there were no negotiations on delimiting the borders. Despite the complexity of the situation, I immediately issued instructions to Russian government agencies to speed up their work to document the borders, so that everyone had a clear understanding that by agreeing to delimit the border we admitted de facto and de jure that Crimea was Ukrainian territory, thereby closing the issue.

We accommodated Ukraine not only regarding Crimea, but also on such a complicated matter as the maritime boundary in the Sea of Azov and the Kerch Strait. What we proceeded from back then was that good relations with Ukraine matter most for us and they should not fall hostage to deadlock territorial disputes. However, we expected Ukraine to remain our good neighbour, we hoped that Russian citizens and Russian speakers in Ukraine, especially its southeast and Crimea, would live in a friendly, democratic and civilised state that would protect their rights in line with the norms of international law.

However, this is not how the situation developed. Time and time again attempts were made to deprive Russians of their historical memory, even of their language and to subject them to forced assimilation. Moreover, Russians, just as other citizens of Ukraine are suffering from the constant political and state crisis that has been rocking the country for over 20 years.

I understand why Ukrainian people wanted change. They have had enough of the authorities in power during the years of Ukraine’s independence. Presidents, prime ministers and parliamentarians changed, but their attitude to the country and its people remained the same. They milked the country, fought among themselves for power, assets and cash flows and did not care much about the ordinary people. They did not wonder why it was that millions of Ukrainian citizens saw no prospects at home and went to other countries to work as day labourers. I would like to stress this: it was not some Silicon Valley they fled to, but to become day labourers. Last year alone almost 3 million people found such jobs in Russia. According to some sources, in 2013 their earnings in Russia totalled over $20 billion, which is about 12% of Ukraine’s GDP.

I would like to reiterate that I understand those who came out on Maidan with peaceful slogans against corruption, inefficient state management and poverty. The right to peaceful protest, democratic procedures and elections exist for the sole purpose of replacing the authorities that do not satisfy the people. However, those who stood behind the latest events in Ukraine had a different agenda: they were preparing yet another government takeover; they wanted to seize power and would stop short of nothing. They resorted to terror, murder and riots. Nationalists, neo-Nazis, Russophobes and anti-Semites executed this coup. They continue to set the tone in Ukraine to this day.

The new so-called authorities began by introducing a draft law to revise the language policy, which was a direct infringement on the rights of ethnic minorities. However, they were immediately ‘disciplined’ by the foreign sponsors of these so-called politicians. One has to admit that the mentors of these current authorities are smart and know well what such attempts to build a purely Ukrainian state may lead to. The draft law was set aside, but clearly reserved for the future. Hardly any mention is made of this attempt now, probably on the presumption that people have a short memory. Nevertheless, we can all clearly see the intentions of these ideological heirs of Bandera, Hitler’s accomplice during World War II.

It is also obvious that there is no legitimate executive authority in Ukraine now, nobody to talk to. Many government agencies have been taken over by the impostors, but they do not have any control in the country, while they themselves – and I would like to stress this – are often controlled by radicals. In some cases, you need a special permit from the militants on Maidan to meet with certain ministers of the current government. This is not a joke – this is reality.

Those who opposed the coup were immediately threatened with repression. Naturally, the first in line here was Crimea, the Russian-speaking Crimea. In view of this, the residents of Crimea and Sevastopol turned to Russia for help in defending their rights and lives, in preventing the events that were unfolding and are still underway in Kiev, Donetsk, Kharkov and other Ukrainian cities.

Naturally, we could not leave this plea unheeded; we could not abandon Crimea and its residents in distress. This would have been betrayal on our part.

First, we had to help create conditions so that the residents of Crimea for the first time in history were able to peacefully express their free will regarding their own future. However, what do we hear from our colleagues in Western Europe and North America? They say we are violating norms of international law. Firstly, it’s a good thing that they at least remember that there exists such a thing as international law – better late than never.

Secondly, and most importantly – what exactly are we violating? True, the President of the Russian Federation received permission from the Upper House of Parliament to use the Armed Forces in Ukraine. However, strictly speaking, nobody has acted on this permission yet. Russia’s Armed Forces never entered Crimea; they were there already in line with an international agreement. True, we did enhance our forces there; however – this is something I would like everyone to hear and know – we did not exceed the personnel limit of our Armed Forces in Crimea, which is set at 25,000, because there was no need to do so.

Next. As it declared independence and decided to hold a referendum, the Supreme Council of Crimea referred to the United Nations Charter, which speaks of the right of nations to self-determination. Incidentally, I would like to remind you that when Ukraine seceded from the USSR it did exactly the same thing, almost word for word. Ukraine used this right, yet the residents of Crimea are denied it. Why is that?

Moreover, the Crimean authorities referred to the well-known Kosovo precedent – a precedent our western colleagues created with their own hands in a very similar situation, when they agreed that the unilateral separation of Kosovo from Serbia, exactly what Crimea is doing now, was legitimate and did not require any permission from the country’s central authorities. Pursuant to Article 2, Chapter 1 of the United Nations Charter, the UN International Court agreed with this approach and made the following comment in its ruling of July 22, 2010, and I quote: “No general prohibition may be inferred from the practice of the Security Council with regard to declarations of independence,” and “General international law contains no prohibition on declarations of independence.” Crystal clear, as they say.

I do not like to resort to quotes, but in this case, I cannot help it. Here is a quote from another official document: the Written Statement of the United States America of April 17, 2009, submitted to the same UN International Court in connection with the hearings on Kosovo. Again, I quote: “Declarations of independence may, and often do, violate domestic legislation. However, this does not make them violations of international law.” End of quote. They wrote this, disseminated it all over the world, had everyone agree and now they are outraged. Over what? The actions of Crimean people completely fit in with these instructions, as it were. For some reason, things that Kosovo Albanians (and we have full respect for them) were permitted to do, Russians, Ukrainians and Crimean Tatars in Crimea are not allowed. Again, one wonders why.

We keep hearing from the United States and Western Europe that Kosovo is some special case. What makes it so special in the eyes of our colleagues? It turns out that it is the fact that the conflict in Kosovo resulted in so many human casualties. Is this a legal argument? The ruling of the International Court says nothing about this. This is not even double standards; this is amazing, primitive, blunt cynicism. One should not try so crudely to make everything suit their interests, calling the same thing white today and black tomorrow. According to this logic, we have to make sure every conflict leads to human losses.

I will state clearly – if the Crimean local self-defence units had not taken the situation under control, there could have been casualties as well. Fortunately this did not happen. There was not a single armed confrontation in Crimea and no casualties. Why do you think this was so? The answer is simple: because it is very difficult, practically impossible to fight against the will of the people. Here I would like to thank the Ukrainian military – and this is 22,000 fully armed servicemen. I would like to thank those Ukrainian service members who refrained from bloodshed and did not smear their uniforms in blood.

Other thoughts come to mind in this connection. They keep talking of some Russian intervention in Crimea, some sort of aggression. This is strange to hear. I cannot recall a single case in history of an intervention without a single shot being fired and with no human casualties.

Colleagues,

Like a mirror, the situation in Ukraine reflects what is going on and what has been happening in the world over the past several decades. After the dissolution of bipolarity on the planet, we no longer have stability. Key international institutions are not getting any stronger; on the contrary, in many cases, they are sadly degrading. Our western partners, led by the United States of America, prefer not to be guided by international law in their practical policies, but by the rule of the gun. They have come to believe in their exclusivity and exceptionalism, that they can decide the destinies of the world, that only they can ever be right. They act as they please: here and there, they use force against sovereign states, building coalitions based on the principle “If you are not with us, you are against us.” To make this aggression look legitimate, they force the necessary resolutions from international organisations, and if for some reason this does not work, they simply ignore the UN Security Council and the UN overall.

This happened in Yugoslavia; we remember 1999 very well. It was hard to believe, even seeing it with my own eyes, that at the end of the 20th century, one of Europe’s capitals, Belgrade, was under missile attack for several weeks, and then came the real intervention. Was there a UN Security Council resolution on this matter, allowing for these actions? Nothing of the sort. And then, they hit Afghanistan, Iraq, and frankly violated the UN Security Council resolution on Libya, when instead of imposing the so-called no-fly zone over it they started bombing it too.

There was a whole series of controlled “colour” revolutions. Clearly, the people in those nations, where these events took place, were sick of tyranny and poverty, of their lack of prospects; but these feelings were taken advantage of cynically. Standards were imposed on these nations that did not in any way correspond to their way of life, traditions, or these peoples’ cultures. As a result, instead of democracy and freedom, there was chaos, outbreaks in violence and a series of upheavals. The Arab Spring turned into the Arab Winter.

A similar situation unfolded in Ukraine. In 2004, to push the necessary candidate through at the presidential elections, they thought up some sort of third round that was not stipulated by the law. It was absurd and a mockery of the constitution. And now, they have thrown in an organised and well-equipped army of militants.

We understand what is happening; we understand that these actions were aimed against Ukraine and Russia and against Eurasian integration. And all this while Russia strived to engage in dialogue with our colleagues in the West. We are constantly proposing cooperation on all key issues; we want to strengthen our level of trust and for our relations to be equal, open and fair. But we saw no reciprocal steps.

On the contrary, they have lied to us many times, made decisions behind our backs, placed us before an accomplished fact. This happened with NATO’s expansion to the East, as well as the deployment of military infrastructure at our borders. They kept telling us the same thing: “Well, this does not concern you.” That’s easy to say.

It happened with the deployment of a missile defence system. In spite of all our apprehensions, the project is working and moving forward. It happened with the endless foot-dragging in the talks on visa issues, promises of fair competition and free access to global markets.

Today, we are being threatened with sanctions, but we already experience many limitations, ones that are quite significant for us, our economy and our nation. For example, still during the times of the Cold War, the US and subsequently other nations restricted a large list of technologies and equipment from being sold to the USSR, creating the Coordinating Committee for Multilateral Export Controls list. Today, they have formally been eliminated, but only formally; and in reality, many limitations are still in effect.

In short, we have every reason to assume that the infamous policy of containment, led in the 18th, 19th and 20th centuries, continues today. They are constantly trying to sweep us into a corner because we have an independent position, because we maintain it and because we call things like they are and do not engage in hypocrisy. But there is a limit to everything. And with Ukraine, our western partners have crossed the line, playing the bear and acting irresponsibly and unprofessionally.

After all, they were fully aware that there are millions of Russians living in Ukraine and in Crimea. They must have really lacked political instinct and common sense not to foresee all the consequences of their actions. Russia found itself in a position it could not retreat from. If you compress the spring all the way to its limit, it will snap back hard. You must always remember this.

Today, it is imperative to end this hysteria, to refute the rhetoric of the cold war and to accept the obvious fact: Russia is an independent, active participant in international affairs; like other countries, it has its own national interests that need to be taken into account and respected.

At the same time, we are grateful to all those who understood our actions in Crimea; we are grateful to the people of China, whose leaders have always considered the situation in Ukraine and Crimea taking into account the full historical and political context, and greatly appreciate India’s reserve and objectivity.

Today, I would like to address the people of the United States of America, the people who, since the foundation of their nation and adoption of the Declaration of Independence, have been proud to hold freedom above all else. Isn’t the desire of Crimea’s residents to freely choose their fate such a value? Please understand us.

I believe that the Europeans, first and foremost, the Germans, will also understand me. Let me remind you that in the course of political consultations on the unification of East and West Germany, at the expert, though very high level, some nations that were then and are now Germany’s allies did not support the idea of unification. Our nation, however, unequivocally supported the sincere, unstoppable desire of the Germans for national unity. I am confident that you have not forgotten this, and I expect that the citizens of Germany will also support the aspiration of the Russians, of historical Russia, to restore unity.

I also want to address the people of Ukraine. I sincerely want you to understand us: we do not want to harm you in any way, or to hurt your national feelings. We have always respected the territorial integrity of the Ukrainian state, incidentally, unlike those who sacrificed Ukraine’s unity for their political ambitions. They flaunt slogans about Ukraine’s greatness, but they are the ones who did everything to divide the nation. Today’s civil standoff is entirely on their conscience. I want you to hear me, my dear friends. Do not believe those who want you to fear Russia, shouting that other regions will follow Crimea. We do not want to divide Ukraine; we do not need that. As for Crimea, it was and remains a Russian, Ukrainian, and Crimean-Tatar land.

I repeat, just as it has been for centuries, it will be a home to all the peoples living there. What it will never be and do is follow in Bandera’s footsteps!

Crimea is our common historical legacy and a very important factor in regional stability. And this strategic territory should be part of a strong and stable sovereignty, which today can only be Russian. Otherwise, dear friends (I am addressing both Ukraine and Russia), you and we – the Russians and the Ukrainians – could lose Crimea completely, and that could happen in the near historical perspective. Please think about it.

Let me note too that we have already heard declarations from Kiev about Ukraine soon joining NATO. What would this have meant for Crimea and Sevastopol in the future? It would have meant that NATO’s navy would be right there in this city of Russia’s military glory, and this would create not an illusory but a perfectly real threat to the whole of southern Russia. These are things that could have become reality were it not for the choice the Crimean people made, and I want to say thank you to them for this.

But let me say too that we are not opposed to cooperation with NATO, for this is certainly not the case. For all the internal processes within the organisation, NATO remains a military alliance, and we are against having a military alliance making itself at home right in our backyard or in our historic territory. I simply cannot imagine that we would travel to Sevastopol to visit NATO sailors. Of course, most of them are wonderful guys, but it would be better to have them come and visit us, be our guests, rather than the other way round.

Let me say quite frankly that it pains our hearts to see what is happening in Ukraine at the moment, see the people’s suffering and their uncertainty about how to get through today and what awaits them tomorrow. Our concerns are understandable because we are not simply close neighbours but, as I have said many times already, we are one people. Kiev is the mother of Russian cities. Ancient Rus is our common source and we cannot live without each other.

Let me say one other thing too. Millions of Russians and Russian-speaking people live in Ukraine and will continue to do so. Russia will always defend their interests using political, diplomatic and legal means. But it should be above all in Ukraine’s own interest to ensure that these people’s rights and interests are fully protected. This is the guarantee of Ukraine’s state stability and territorial integrity.

We want to be friends with Ukraine and we want Ukraine to be a strong, sovereign and self-sufficient country. Ukraine is one of our biggest partners after all. We have many joint projects and I believe in their success no matter what the current difficulties. Most importantly, we want peace and harmony to reign in Ukraine, and we are ready to work together with other countries to do everything possible to facilitate and support this. But as I said, only Ukraine’s own people can put their own house in order.

Residents of Crimea and the city of Sevastopol, the whole of Russia admired your courage, dignity and bravery. It was you who decided Crimea’s future. We were closer than ever over these days, supporting each other. These were sincere feelings of solidarity. It is at historic turning points such as these that a nation demonstrates its maturity and strength of spirit. The Russian people showed this maturity and strength through their united support for their compatriots.

Russia’s foreign policy position on this matter drew its firmness from the will of millions of our people, our national unity and the support of our country’s main political and public forces. I want to thank everyone for this patriotic spirit, everyone without exception. Now, we need to continue and maintain this kind of consolidation so as to resolve the tasks our country faces on its road ahead.

Obviously, we will encounter external opposition, but this is a decision that we need to make for ourselves. Are we ready to consistently defend our national interests, or will we forever give in, retreat to who knows where? Some Western politicians are already threatening us with not just sanctions but also the prospect of increasingly serious problems on the domestic front. I would like to know what it is they have in mind exactly: action by a fifth column, this disparate bunch of ‘national traitors’, or are they hoping to put us in a worsening social and economic situation so as to provoke public discontent? We consider such statements irresponsible and clearly aggressive in tone, and we will respond to them accordingly. At the same time, we will never seek confrontation with our partners, whether in the East or the West, but on the contrary, will do everything we can to build civilised and good-neighbourly relations as one is supposed to in the modern world.

Colleagues,

I understand the people of Crimea, who put the question in the clearest possible terms in the referendum: should Crimea be with Ukraine or with Russia? We can be sure in saying that the authorities in Crimea and Sevastopol, the legislative authorities, when they formulated the question, set aside group and political interests and made the people’s fundamental interests alone the cornerstone of their work. The particular historic, population, political and economic circumstances of Crimea would have made any other proposed option – however tempting it could be at the first glance – only temporary and fragile and would have inevitably led to further worsening of the situation there, which would have had disastrous effects on people’s lives. The people of Crimea thus decided to put the question in firm and uncompromising form, with no grey areas. The referendum was fair and transparent, and the people of Crimea clearly and convincingly expressed their will and stated that they want to be with Russia.

Russia will also have to make a difficult decision now, taking into account the various domestic and external considerations. What do people here in Russia think? Here, like in any democratic country, people have different points of view, but I want to make the point that the absolute majority of our people clearly do support what is happening.

The most recent public opinion surveys conducted here in Russia show that 95 percent of people think that Russia should protect the interests of Russians and members of other ethnic groups living in Crimea – 95 percent of our citizens. More than 83 percent think that Russia should do this even if it will complicate our relations with some other countries. A total of 86 percent of our people see Crimea as still being Russian territory and part of our country’s lands. And one particularly important figure, which corresponds exactly with the result in Crimea’s referendum: almost 92 percent of our people support Crimea’s reunification with Russia.

Thus we see that the overwhelming majority of people in Crimea and the absolute majority of the Russian Federation’s people support the reunification of the Republic of Crimea and the city of Sevastopol with Russia.

Now this is a matter for Russia’s own political decision, and any decision here can be based only on the people’s will, because the people is the ultimate source of all authority.

Members of the Federation Council, deputies of the State Duma, citizens of Russia, residents of Crimea and Sevastopol, today, in accordance with the people’s will, I submit to the Federal Assembly a request to consider a Constitutional Law on the creation of two new constituent entities within the Russian Federation: the Republic of Crimea and the city of Sevastopol, and to ratify the treaty on admitting to the Russian Federation Crimea and Sevastopol, which is already ready for signing. I stand assured of your support.

Why support the “We The People” public-oath sticklers who the state is prosecuting like a criminal enterprise? A few reasons: Solidarity. Because as hardheaded as they might be, defendants Stephen Nalty and Steve Byfield are still JUDICIAL REFORM ACTIVISTS. Sense of fair play. Half the courtroom gallery is filled with Colorado Attorney General staffers and FBI special agents chumming it up with jurors and briefing their THREE FBI UNDERCOVER WITNESSES while the defendant pariah side of the audience is warned by the judge that even a whisper will result in ejection. Thrills. Where else are you going to see this many federal agents pushing their weight around, barking at you in the hallways, swaggering gleefully about how much smarter they are than the defendants? Pathos. Come watch the Assistant Fucking Colorado Attorney General, Robert Shapiro himself, lead a team of prosecutors against the unrepresented defendants, watch Shapiro belittle them, lecture them, trivialize their difficulties defending themselves in jail, and pretend they can review “tens of thousands” of pages of evidence and “hours and hours” of undercover surveillance tapes in a single day. Because you can make a difference. Come push the FBI-guys’ buttons. Come witness and document the abuses of the overbearing prosecution team. Come lend public pressure on the judge, whose conscience is already bothering him about how unfair this sham trial has become.

Why support the “We The People” public-oath sticklers who the state is prosecuting like a criminal enterprise? A few reasons: Solidarity. Because as hardheaded as they might be, defendants Stephen Nalty and Steve Byfield are still JUDICIAL REFORM ACTIVISTS. Sense of fair play. Half the courtroom gallery is filled with Colorado Attorney General staffers and FBI special agents chumming it up with jurors and briefing their THREE FBI UNDERCOVER WITNESSES while the defendant pariah side of the audience is warned by the judge that even a whisper will result in ejection. Thrills. Where else are you going to see this many federal agents pushing their weight around, barking at you in the hallways, swaggering gleefully about how much smarter they are than the defendants? Pathos. Come watch the Assistant Fucking Colorado Attorney General, Robert Shapiro himself, lead a team of prosecutors against the unrepresented defendants, watch Shapiro belittle them, lecture them, trivialize their difficulties defending themselves in jail, and pretend they can review “tens of thousands” of pages of evidence and “hours and hours” of undercover surveillance tapes in a single day. Because you can make a difference. Come push the FBI-guys’ buttons. Come witness and document the abuses of the overbearing prosecution team. Come lend public pressure on the judge, whose conscience is already bothering him about how unfair this sham trial has become.

This graphic circulating on the interwebs is a lot easier to find than Vladimir Putin’s March 18 address to the Kremlin about the referendum in Crimea after the

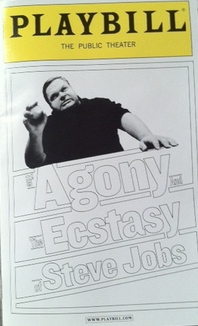

This graphic circulating on the interwebs is a lot easier to find than Vladimir Putin’s March 18 address to the Kremlin about the referendum in Crimea after the  This American Life host Ira Glass tried to pull an Oprah on playwright Mike Daisey, to dress him down on creative license Daisey took with an excerpt of a monolog aired on TAL titled Mr. Daisey and the Apple Factory. The debunking came courtesy of American Public Media’s laughable “Marketplace” Wall Street PR engine, which Glass pretended were reliable experts on the subject of China’s apparently resolved labor abuses. That’s not even funny. This “retraction” reeks even upwind, and Apple’s having become the most highly valued corporation probably explains Glass’s uncharacteristically virulent condemnation. Shameful is what it was, and I hold it unforgivable, for the pretend-affable Glass, so-called folk archivist, to scuttle someone else’s too successful artistic quest for fundamental truth.

This American Life host Ira Glass tried to pull an Oprah on playwright Mike Daisey, to dress him down on creative license Daisey took with an excerpt of a monolog aired on TAL titled Mr. Daisey and the Apple Factory. The debunking came courtesy of American Public Media’s laughable “Marketplace” Wall Street PR engine, which Glass pretended were reliable experts on the subject of China’s apparently resolved labor abuses. That’s not even funny. This “retraction” reeks even upwind, and Apple’s having become the most highly valued corporation probably explains Glass’s uncharacteristically virulent condemnation. Shameful is what it was, and I hold it unforgivable, for the pretend-affable Glass, so-called folk archivist, to scuttle someone else’s too successful artistic quest for fundamental truth. Nobody likes to draw the short straw, but isn’t that already our lot living in Colorado Springs? Yeah, it’s easy to protest Wall Street from the safety of a provincial backwater, our city even backed us with a permit, but is that really grabbing the imperial bull by the horns? The Occupy Movement has spotlighted how the world’s 99% are oppressed by the ruling elite. It made more clear how true democracy is undermined by their military-industrial-corporate-banking complex. Now, doesn’t a major chunk of that alliance operate right where we live? Think. It ain’t banking or industry, and the corporations here orbit around the headliner of that lineup, the military, our city’s dominant export. Yes, criticizing the military in a military town is not popular. Do you think the Wall Street protesters were a welcome sight to Manhattan’s bankers? You can call to “End the Fed” online, or protest anything in the world from a digital soapbox, but a public demonstration is limited to what’s in your local vicinity, especially if you mean to OCCUPY IT. Look on this as a curse or a blessing: The Zuccotti Park activists get to target sharkskin-suited traders, we’re up against men with guns. But what are you going to do, cheerlead the OWS front in NY, or hold up your end of the fight?

Nobody likes to draw the short straw, but isn’t that already our lot living in Colorado Springs? Yeah, it’s easy to protest Wall Street from the safety of a provincial backwater, our city even backed us with a permit, but is that really grabbing the imperial bull by the horns? The Occupy Movement has spotlighted how the world’s 99% are oppressed by the ruling elite. It made more clear how true democracy is undermined by their military-industrial-corporate-banking complex. Now, doesn’t a major chunk of that alliance operate right where we live? Think. It ain’t banking or industry, and the corporations here orbit around the headliner of that lineup, the military, our city’s dominant export. Yes, criticizing the military in a military town is not popular. Do you think the Wall Street protesters were a welcome sight to Manhattan’s bankers? You can call to “End the Fed” online, or protest anything in the world from a digital soapbox, but a public demonstration is limited to what’s in your local vicinity, especially if you mean to OCCUPY IT. Look on this as a curse or a blessing: The Zuccotti Park activists get to target sharkskin-suited traders, we’re up against men with guns. But what are you going to do, cheerlead the OWS front in NY, or hold up your end of the fight? This image gets my vote for the KILLER APP of internet memes to explain what the “economic crisis” and its global banking “austerity measures” are really about: pure greed.

This image gets my vote for the KILLER APP of internet memes to explain what the “economic crisis” and its global banking “austerity measures” are really about: pure greed.

It might stretch credulity that the US Bureau of Engraving encrypted prophetic images of the Pentagon –and the not yet built WTC twin towers– in their iconic Reichstag Fire infamy, unto dollar bills folded just so. But who knows, they might have chosen to encode Thomas Jefferson’s oft-quoted but unheeded chiding to the American people: “Every generation needs a new revolution.” And don’t we especially want to ignore this one? “When injustice becomes law, rebellion becomes duty.”

It might stretch credulity that the US Bureau of Engraving encrypted prophetic images of the Pentagon –and the not yet built WTC twin towers– in their iconic Reichstag Fire infamy, unto dollar bills folded just so. But who knows, they might have chosen to encode Thomas Jefferson’s oft-quoted but unheeded chiding to the American people: “Every generation needs a new revolution.” And don’t we especially want to ignore this one? “When injustice becomes law, rebellion becomes duty.”

My Dem friends are protesting the Debt Ceiling Heist outside of 5th District Congressman Doug Lamborn’s office, even though today the relevant vote is in the Senate, and Senator Michael Bennet has an office downtown. Except he’s a Democrat. AS IF my colleagues think only the Republicans are screwing them on the debt crisis “deal!” Much as I object to being represented by the squeaky voiced pea-brain bigoted Lamborn, this Move-On crowd

My Dem friends are protesting the Debt Ceiling Heist outside of 5th District Congressman Doug Lamborn’s office, even though today the relevant vote is in the Senate, and Senator Michael Bennet has an office downtown. Except he’s a Democrat. AS IF my colleagues think only the Republicans are screwing them on the debt crisis “deal!” Much as I object to being represented by the squeaky voiced pea-brain bigoted Lamborn, this Move-On crowd  pretends their corporate party offers a veritable alternative. Senator Bennet is a pro-banking, pro-privatization, pro-military, frack-the-environment, blue dog centrist, who quite righty takes progressive liberals for schmucks.

pretends their corporate party offers a veritable alternative. Senator Bennet is a pro-banking, pro-privatization, pro-military, frack-the-environment, blue dog centrist, who quite righty takes progressive liberals for schmucks.